Case Study: KYC & AML Compliance System

Insurance Corporation of Belize KYC & AML Compliance System

Project Overview

The Insurance Corporation of Belize (ICB) needed a comprehensive system to meet the growing demands of financial compliance with international and local regulations such as KYC and AML. They required a solution that could catalog and index essential data, making it easily searchable for compliance and due diligence checks. As the sole developer, I designed and implemented a custom solution that allowed ICB to automate critical aspects of their regulatory compliance processes. The system featured key modules such as data management integrations, a search module, and periodic checks of existing records within ICB’s underwriting system, ensuring a smooth and compliant workflow.

The Challenge

ICB faced the challenge of maintaining compliance with ever-evolving financial regulations, including international standards set by the United Nations (UN), the Office of Foreign Assets Control (OFAC), and the Financial Action Task Force (FATF), as well as local government requirements. They needed a system that could efficiently manage vast amounts of customer data, track all compliance checks, and provide proof of due diligence while being easy to navigate. Additionally, integrating the new system with their existing underwriting platform was crucial to ensure that all customer records were routinely checked and updated to meet compliance standards.

The Approach & Solution

To meet these challenges, I built a scalable and flexible KYC and AML Compliance System using Grails for the backend and Bootstrap for the frontend. The solution included several key modules:

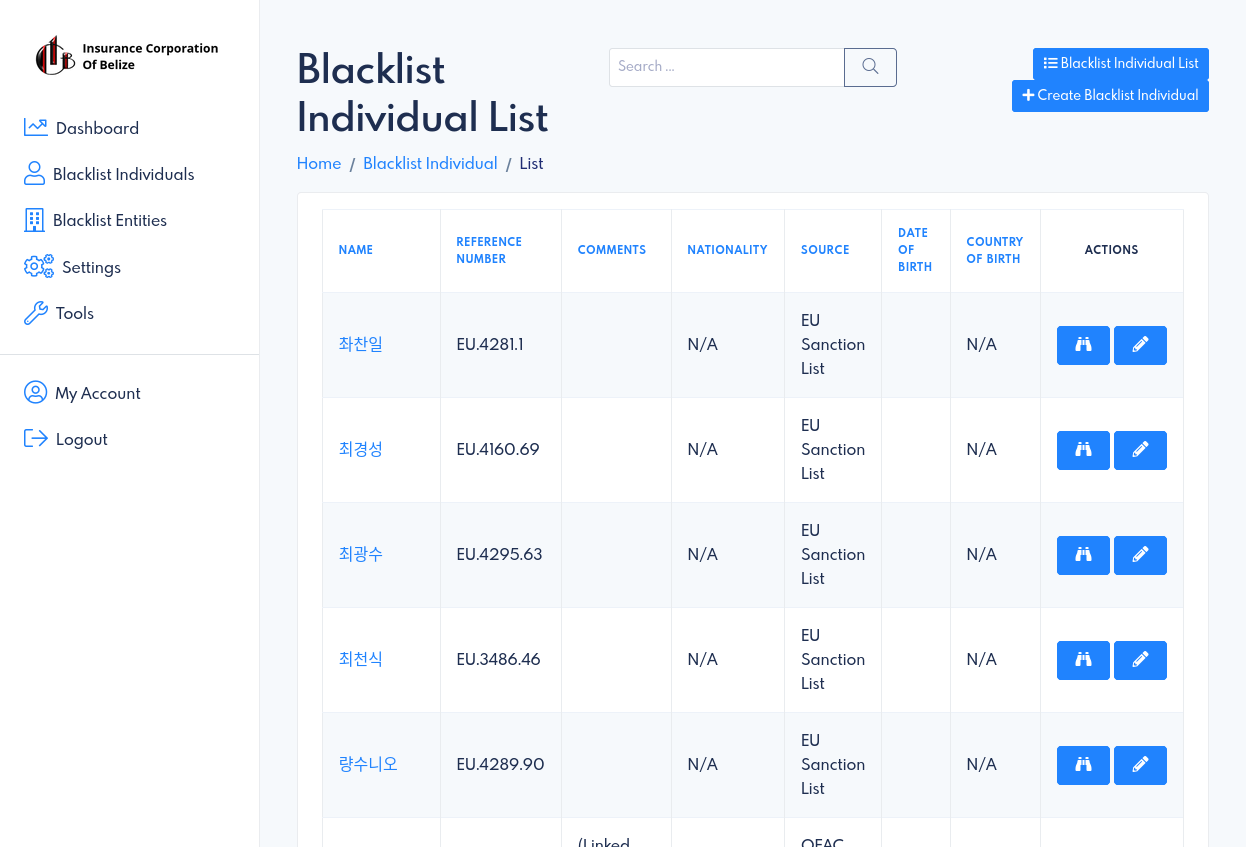

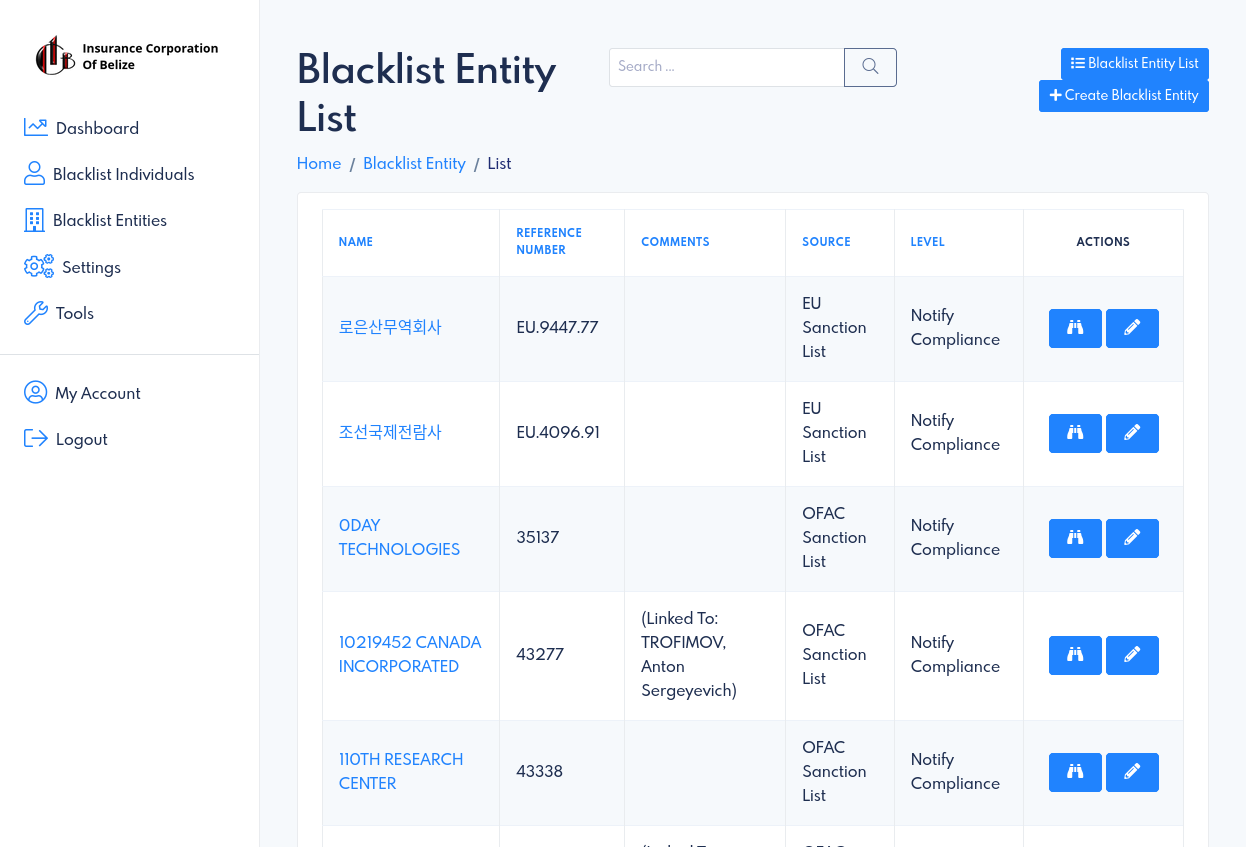

- Data Management: I built integrations with major international blacklists (UN, OFAC, FATF) and local government lists to ensure that ICB’s customer data was continuously checked against these trusted sources. This allowed ICB to remain compliant without manual intervention.

- Search Module: A robust search feature was implemented to allow ICB staff to track and document every search query that came into the system. This module ensured the organization could demonstrate proof of due diligence in line with compliance regulations, keeping a detailed log of all checks performed.

- Integration with Underwriting System: I integrated the new compliance system with ICB’s existing underwriting platform to periodically scan customer records, ensuring all clients were validated against compliance requirements. This automated process minimized manual checks and reduced the risk of overlooking non-compliant clients.

The Results

The KYC and AML Compliance System led to significant improvements across ICB’s operations. The results can be broken down into four key pillars of success:

The successful implementation of the KYC and AML Compliance System has empowered the Insurance Corporation of Belize to stay compliant with financial regulations while improving operational efficiency. By automating key processes, streamlining data management, and integrating seamlessly with their existing systems, the solution has not only reduced costs but also strengthened ICB’s ability to maintain the highest standards of regulatory compliance. I am proud to have contributed to this project and look forward to its continued success in supporting ICB’s operations.